Reporting

FirstCU Online Security

Guidance for Online Protection

Security Factors

- Something that the user knows (such as a password or PIN)

- Something that the user has (such as your ATM or debit card)

- Something that the user is (such as a fingerprint)

Layered Security

Internal Assessments

- Changes in the internal and external threat environment

- Changes in the member base adopting electronic banking

- Changes in the member functionality offered through electronic banking

- Actual incidents of security breaches, identity theft, or fraud

Reg E Protections

First Line of Defense is You

- Anti-virus software

- Anti-malware programs

- Firewalls

- Operating system patches and updates

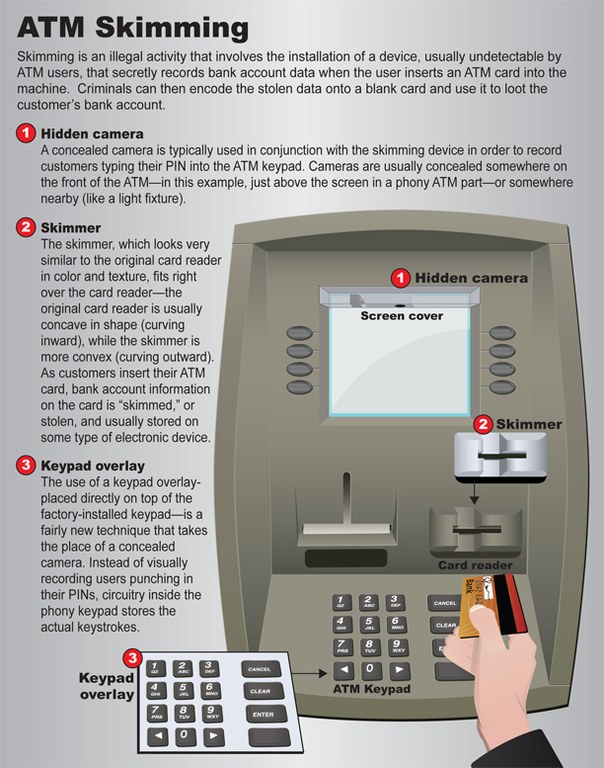

4 Ways to Spot a Skimmer:

- Use your eyes. Check out the card reader very carefully. Do the numbers on the PIN pad look raised? Do they look newer or bigger than the rest of the machine? Does anything look like it doesn’t belong?

- Use your fingers. Feel the card reader before sliding your card into the slot. Do the keys feel raised? Is it difficult to insert your card? These are both red flags that the card reader may have been fitted with a skimming device.

- Hidden cameras are used in conjunction with the skimmer to make a video of your PIN number. The camera may be placed in a number of locations: on the ATM itself (near the keypad, above the screen, etc.) or nearby. Sometimes they’re so small they can be hidden in a tiny opening on the ATM.

- Watch for discrepancies in the shape, material, color, or contours of the ATM. If you notice slashes, cracks, scratches, and other signs of mechanical damage to the ATM, find another ATM location to use.

12 WAYS TO PRACTICE SAFE ATM TRANSACTIONS

SCAM ALERT WARNINGs

We urge all members to ignore phone, text, or internet requests for money or access to their computer, accounts, or personal information. Legitimate companies, the IRS, or Social Security will not make these requests, but scammers will. Please contact the credit union at our listed number 614-836-0100 if you have questions about your account or an inquiry you receive on your account. If we contact you, we will never ask for your account number or social security number, we have that information on file.

DO NOT PROVIDE YOUR ACCOUNT NUMBER

Anytime that you are contacted by someone that states they are from First Service or our security team and they ask for your account number, it is a SCAM and FRAUD. If an employee of the credit union or our security team contacts you, we will already have your account number and your full social security number – it is all part of our file information. Do not provide your account number, password, or social security number for phone, email or text contacts.

DO NOT HIT REDIAL

If you receive a call and anyone asks for your account number, simply hang up and contact us by Dialing (614)836-0100 or toll free (800) 241-4575 if you are out of the local area. Do Not Hit Redial. If our number has been “spoofed” and you hit Redial, you will get the fraudsters back on your phone. The "spoofed" call may appear to be from the credit union's phone number, but it is actually fraud - remember, we already have your account number.

FRAUD ALERTS

- Never release your account number, password, or personal information to unsolicited e-mail, telephone calls or text messages.

- Keep your checks, plastic cards, and personal identification number(s) secure.

- Do not wire funds to unknown contacts.

- Sign up for online account access at FirstCU Online.

Be Safe With These Tips:

- Beware of e-Mails (phishing)

- Impostors can create fake web sites - down to the logo. If you get an e-mail that asks you to go to a web site and input personal details, ignore it! No bank, credit card company or your credit union will send an e-mail asking for this information.

- Do not open e-mails, click on embedded links or open attachments from unknown senders. First Service will not contact you for personal information, or to verify information, by e-mail.

- You can make your computer safer by installing and updating regularly your anti-virus software, anti-malware programs, firewalls, and operating system patches and updates.

- Impostors can create fake web sites - down to the logo. If you get an e-mail that asks you to go to a web site and input personal details, ignore it! No bank, credit card company or your credit union will send an e-mail asking for this information.

- Watch Your Mail

- Thieves can nab your statement, a credit card bill or other valuable information and change the address hoping you won't notice. Statements arrive on a regular cycle; if yours doesn't arrive, let the company know. We provide free online e-Statements to help protect our members from mail fraud.

- Thieves can nab your statement, a credit card bill or other valuable information and change the address hoping you won't notice. Statements arrive on a regular cycle; if yours doesn't arrive, let the company know. We provide free online e-Statements to help protect our members from mail fraud.

- Guard Your Social Security Number

- A zillion places will request your social security number, but you don't have to tell them. Who is entitled to know? Your employer, the DMV, your credit union or bank and the IRS.

- A zillion places will request your social security number, but you don't have to tell them. Who is entitled to know? Your employer, the DMV, your credit union or bank and the IRS.

- Cell Phones & Text Messages

- Do not respond to cell phone text messages from unknown sources. Thieves will send out text messages looking for personal information.

If you receive such a call, text or e-mail, dial the business direct at their published number to verify the call.

For First Service accounts, DIAL 614-836-0100 locally or toll free 1-800-241-4578 for long distance and speak to a Member Service Representative. If you were contacted by phone, do not hit "Redial". If the credit union's phone number was "spoofed" by fraudsters, you will call them back, instead dial the First Service number.

Examples of RECENT SCAMS:

- You receive a call from your financial institution's "security team" and are asked for your account number. They give you the last 4 digits of your social security number. This is a scam! If your credit union calls, we will already know your account number, which is what the fraudster is looking for. Hang Up!

Do Not Hit Redial. If the phone number was "spoofed" and you hit Redial, you will contact the fraudster. The "spoofed" call may appear to be from your credit union, but it is actually fraud - remember, we already have your account number. Instead, for First Service accounts, contact a Member Service Representative by DIALING 614-836-0100 locally or toll free 1-800-241-4578 and speak to a Member Service Representative. - The FBI issued an alert about a new scam. This is an email you receive which threatens to make public all your private personal information, unless you pay a ransom in an electronic currency called Bitcoin. It is easy to get intimidated by threats like this, and you might be pushed into trying to prevent possible negative consequences. However, do not fall for pressure tactics like this, because if you do, your data will be sold to other scammers who will continue to haunt you. If you receive email extortion demands, do not answer, and do not pay anything. Report this scam to the FBI's Internet Crime Complaint Center (IC3) at http://www.ic3.gov/default.aspx. Remember... Always Think Before You Click!

- Here is a recent VISA scam, but this could be from another provider as well. The call has the appearance of being from VISA Security and Fraud Department. The difference with this Scam from others is that the caller has most of the information, which they provide to the Cardholder (instead of asking for information), and then they ask you to verify that the card is in your possession. To verify this, the caller will ask you to provide the numbers from the back of your card. That is the "missing piece of information" that the caller needs to use the card fraudulently. DO NOT PROVIDE THE CARD NUMBERS from the back of your card! Instead, tell them you'll call VISA directly for verification of the conversation and HANG UP!

- A Member reported an "advertisement" on the First Service web site. We DO NOT sell ad space on our web site. This is a virus from a program on your computer and is not embedded in our site. DO NOT RESPOND to the ad.

- Advertisements have been posted on Craigslist as part of member recruitment scams nationwide. The ads solicit current credit union members and offer $75.00 or more for their assistance in gaining membership for ineligible individuals. This Is a SCAM targeting credit unions and members across the country!

- An IRS scam asks you to respond to them concerning your last tax return. This is fraud. DO NOT REPLY. The IRS will not ask you to verify information by e-mail or text.

- If you are contacted and asked to provide credit union account information to verify your home or auto insurance, DO NOT REPLY! Instead, call your insurance agent at their direct number.

Card Protection Service

This will help you ensure fraudulent accounts have not been opened using your personal information. Additionally, the Fair Credit Reporting Act entitles consumers to a free credit report once a year from each of the three nationwide credit reporting agencies. Members can receive their report by contacting the credit reporting agencies directly or by visiting www.annualcreditreport.com.

Get into the routine of regularly checking your statements, reviewing your account transactions, and online activities. This will help identify unauthorized account activities early, preventing potential losses to your personal accounts.

Fraudsters will often use a game or a free offer that will request personal information, or will include spy ware to track and steal information from your computer or mobile device. Parents can protect themselves by encouraging their children to limit online contact to friends they actually know, setting privacy controls to restrict access to private information, and enabling parental controls that allow access to only trusted sites. Talk to your children about not giving out their name, address, date of birth, or any other personal information online without talking to a parent or trusted adult first.

Smart phone or social networking applications may provide application developers with access to your personal information, such as messages, contacts, e-mails and photos. Often, this information isn't related to the application's purpose. Instead developers may share member's information with marketers or other third parties. Consumers should read the privacy policy of each application before downloading to understand what private information they are sharing.

Financial statements, credit card offers and billing statements are examples of documents that should be shredded.

Fraudsters may impersonate a credit union (or other legitimate organizations) to trick consumers into giving out personal account information. This social engineering tactic is often utilized as part of an elaborate scheme involving phone calls, emails, text messages and other forms of communication. First Service will not ask you to verify account information by text, e-mail or pop-up messages. We will not ask you for sensitive information over unsecured communication channels.

U.S. Patriot Act

The Unlawful Internet Gambling Enforcement Act of 2006 and implementing regulations prohibit commercial members from receiving deposit or other credits of any kind relating to their operation of an illegal Internet gambling business. Under the Act, any person engaged in the business of betting or wagering (as defined by the statute) is prohibited from completing "restricted transactions," or knowingly accepting payments in connection with the participation of another person in unlawful Internet gambling.

Your federal savings insurance coverage at First Service has increased to $250,000. Funds in your Individual Retirement Account are insured separate from and in addition to the $250,000 general share insurance rules.

Bauer Financial Services has given First Service a 5-STAR rating for Safety and Soundness. Learn more about their ratings.

|

Important Information You Should Know

|

Look at the machine you are using for a skimming device.

This device is an insert on a machine where you slide or insert your card. If this area is not flat on the machine, do not insert your card.

Don’t Fall for these Common Scams

Be aware of these latest common scams to protect your money and personal information from potential scammers. If you are contacted and spot one of these scam tactics and it involves your credit union account, call us immediately at 614-836-0100 locally or 800-241-4575 for out of area. If you receive a suspicious call, it may be a "spoofed" number so instead of hitting Redial, dial the credit union's number to report the call. If you feel your credit or debit card has been compromised, report it to the loss prevention number on the back of your card.

Calls asking for your account number

Fraudsters will call asking for your Account Number. They may represent themselves as employees or members of a security team. Remember, First Service already has your account number, account information, and social security number. Never give your account number, password, social security number, account information or personal information to callers or provide through emails or texts.

Gift card scams

Scammers will contact you pretending to be someone they are not such as a company, financial institution, or government agency that you may owe. They will raise an urgent and immediate demand for payment to convince you to pay with a gift card (and even cash) or face legal action. By creating a false sense of urgency, they pressure you into buying gift cards and sharing the numbers on the back.

Helpful Tip: Businesses and government agencies will never ask you to pay with gift cards. Never give the number on the back of a gift card to anyone you don’t know.

Payment scams

Be wary if you are urged to make a purchase with the promise of compensation, or if someone offers to make a payment for you or provides you with their bank account info with which to make a payment. If something sounds too good to be true, it generally is. If you use a payment method you are not familiar with, you run the risk of ultimately being held responsible for the amount paid.

Helpful Tip: If there is an urgency to the payment method (such as a wire payment) it is even more likely to be a scam.

Tech support scams

"Tech support" will call and claim your computer has malware and requests payment to fix the defects or request access to your computer to fix. If you get such a call, hang up! This is a scam.

Helpful Tip: Do not give your computer information to an unknown caller, you run the risk of them taking over control of your computer and your credit union account.

Employment scams

Be vigilant in validating employment opportunities. If you are contacted about a new job, never divulge personal information online to an unsolicited, unknown source. Instead, call the personnel department on a listed number for any company that you believe may legitimately have an employment opportunity for you. Also be suspicious if someone claims to have overpaid you for a job, promises to reimburse you for equipment, or asks you to send equipment to an IT dept. The equipment may never be returned, and reimbursements or overpayments may be illegitimate, leaving you liable for the funds.

Impersonation scams

Scammers often pose as a legitimate company or as a utility company and request personal information or a payment transfer in order to make things "right" on your account. They might also use a fake caller ID that could show up as a legit company's number and/ or request remote access to your device. A scammer posing as a representative from a utility company might warn you to pay your balance within a limited time or else the utility will be shut off. They promote an urgency to the call which is a warning that this is a scam.

Helpful Tip: Instead, pull out a statement or look online and find a number to contact the company direct.

QR code scams

It is safer to only scan QR codes for sources and companies that are familiar to you. Scammers may have 3rd party QR code scanner apps and/or ads within their apps that direct users to fake or malicious websites designed to obtain your personal information.

Helpful Tip: Know who you are contacting to stay safe.

Fake websites

Legitimate-looking websites can be created by scammers, and a quick Google search will lead you to a real-looking phone number that is actually bogus. When you call, they’ll try to obtain your sign-in details such as your password or other confidential information.

Helpful Tip: Always verify phone numbers to contact through your own personal sources, such as published numbers and never disclose your username or passwords to others.

Overpayment scams

This scam is becoming more common. You are selling an item and receive an overpayment for an item you’re selling, immediately followed by a request to deposit the check (which turns out to be a bad check) and then send the difference via a wire or gift card. You are then out your hard-earned money because the check you received is worthless.

Helpful Tip: Do not send money or gift cards at the request of someone you do not know.

Check cashing

You’re approached outside your credit union branch or any financial office and asked to cash a check for someone who claims they don’t have an account or left their ID at home. You will be responsible for their bad check deposited against your account when it doesn’t clear. If the check was involved in a crime, it could also implicate you.

Helpful Tip: Do not provide check cashing services for others.

Charity scams

You receive a request to donate to a charity that you've never heard of and for which you can’t find an official website. There is an urgency to the donation – they need it for something immediately.

Helpful Tip: Only make donations to charities that you have knowledge of and never feel pressured to act immediately. The FTC.Gov provides guidance to help you donate wisely.

Debt relief

You receive a request for payment in order to establish a service relationship to pay, settle or get rid of debt you have already established. Do not reply to this request. Legitimate companies will not ask for payment in a gift card.

Helpful Tip: Only work with your known sources for payments or settlements.

IRS scams

Scam artists are pretending to be IRS officials to get your money. They'll call, email, or text you claiming you owe back taxes or there's a problem with your tax return. They even rig caller ID to make their call look official. They play on your fears and establish an urgency for you to respond. The IRS will not contact you in a call, email or text for payment and they will not ask for payment with a gift card or cash.

Helpful Tips: If you are unsure of any IRS correspondence you receive for payment, then get in touch with your local IRS office through their published number.

Investment scams

You receive a request to invest in a business opportunity with promises of high returns and/or getting-rich-quick. “Getting rich quickly or double-your-money” is an unrealistic financial promise. Question any appealing investment offers that guarantee you huge returns.

Helpful Tip: Before spending any money, look up the business at trustworthy resources to verify their legitimacy and work through investors and financial consultants that you contact through regular channels.

Lottery scams

You receive a request to prepay fees or taxes in order to receive a large prize you supposedly won. This is a scam! Don’t reply.

Grandparent scam

You receive a call or text message from someone claiming to be a grandchild or loved one asking for money to help with an emergency, plus instructions on where to send the funds. Their voice may have even been duplicated. Do not respond.

Helpful Tip: Call the police immediately to file a report.

Puppy scam

Scammers post fake litters online or pretend to be someone they're not (usually an existing breeder) to take advantage of puppy sales (sans the puppies.)

Helpful Tip: Buy only from known breeders or established kennels, persons you know or referrals from friends and family.

Online Shopping Marketplace Scams

Online shoppers can be deceived by scammers setting up fake websites or social media ads to offer attention-grabbing deals. When responding to ads or interacting in marketplaces on social media, research sellers and products independently to ensure legitimacy. Notice the red flags like a high-ticket item for a price too-good-to-be-true or someone asking for personal information or being redirected to an unfamiliar/strange looking URL. Look at the number of successful sales in a merchant or dealer's reviews.

Helpful Tip: Always check ratings, reviews and other listings about a business or person to verify their trustworthiness and authenticity. Beware of deals that sound too good to be true, especially when found on lesser-known or newer sites. Never send deposits to hold items before confirming they’re real.

Cryptocurrency scams

Scammers can impersonate new or established businesses offering fraudulent crypto coins or tokens with promises of high returns. They might create click social media ads, news articles, or websites and trick new investors into buying. These fake investment opportunities may require high up-front fees that supposedly get invested in crypto, but actually go directly into the scammer’s pocket.

Helpful tip: Question any appealing investment offers that guarantee huge returns. Before sending any money, look up the business at trustworthy resources online to verify legitimacy.

Mortgage closing

You receive an email or text message that looks similar to your real estate agent’s contact info that indicates there is a last-minute change to the wiring instructions on a mortgage closing, telling you to wire closing costs to a different account. Do not wire any funds without contacting your agent immediately at the number they have provided you previously.